If you’re a Xero user, check out Hubdoc for effortless expense management. The average accountant charges $150 to $450 per hour, depending on factors like their years of experience, the type of work, the size of the business, and the location. Some accountants may charge a flat fee along with additional, variable rates. GnuCash is appealing for its fully free software and benefits that come with open-source technology, like faster iteration and improvement due to its crowdsourced development and testing.

- Learn how to calculate net income with our easy-to-follow net income formula, which will help you understand your bottom line and maximise profits.

- This will help you track the business-related expenditure and separate it from your personal finances.

- FreshBooks pricing starts at $15/month for the Lite version, which is perfect for freelancers and contractors, with the option to move up to the popular Plus plan at $25/month at any time.

- Read this guide to discover financial reporting and the different accounting systems, accounting software, and whether you can do your own small business accounting.

- Using accounting software can allow you to save time when managing the books for your business.

- This is the reason a majority of small business owners either hire accountants to compile financial statements or use an accounting software for efficient recordkeeping.

Does my small business need a CPA?

Now that you know the five main account types, you should begin to familiarize yourself with some other accounting basics. If you’re using accrual, or double-entry accounting, you will need to understand the accounting equation and debits and credits, which are the backbone of any accounting system. But even if you’re ready to find an accounting software application that’s right https://www.simple-accounting.org/ for your business, there are a few other things you need to do first. Though not a recommended method, all you need to start doing accounting for your business is a pencil and paper, and a lot of patience. Bryce Warnes is a writer for Bench, the online bookkeeping service that pairs you with a team of professional bookkeepers who do your bookkeeping, so you don’t have to.

How Do You Keep Books for a Small Business?

Much like a filing cabinet, every account type acts as a drawer, and each account code is a folder within that drawer. It’s essentially a guide for how you file income and expenditure in your business. That’s not to say your bookkeeper won’t handle tax, or https://www.business-accounting.net/accounting-consulting-accounting-consulting-how-to/ your accountant won’t handle some small business bookkeeping tasks. You’ll need to do elements of both (or have them done for you) if you’re running a small business. Most small business owners set out with a mission in mind – doing more of what they love.

Choosing an Accounting Method

The type of business or industry and number of employees are two major factors to consider when choosing the best accounting software system. Managing profit and loss in business accounting involves calculating revenue and finding ways to cut costs. Profits are earnings or cash in, and loss refers to anything the company has to pay for or money out—record profits and losses on a profit-and-loss statement or income statement.

What method should you choose to keep your books?

Deskera allows you to integrate your bank accounts directly in order to track payments and expenses automatically. When a payment is processed, the bank and the accounts receivable are adjusted automatically by the accounting software. While other financial statements report data for a period of time (a month, a quarter, or a year), the balance sheet reflects the company’s financials standing at that specific instant. As a responsible business owner, you need to record every single financial transaction you make—so the answer might depend on how many bills you pay and invoices you send out. At the very least, you’ll want to sit down for bookkeeping monthly, but we strongly recommend you update your books at least weekly, though preferably daily.

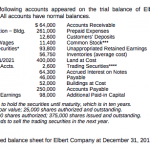

Adjusted Trial Balance

Free accounting software should come with most of the features you’re looking for, and if it doesn’t, it’s probably worth subscribing to a paid product instead. If you’re a solo entrepreneur, professional services provider, or freelancer (like me), you might have simpler business finances, but still want to save time on tax prep and invoicing. You can choose a lower-cost “light” version of accounting software that gives you just what you need, without all the advanced features. The best accounting software tools have a wide range of features and different recommended plans based on your number of employees. Some accounting software also includes bill pay and payroll software, so you can run payroll and manage other aspects of your business finances all in one place.

Your Xero data is backed up regularly and protected with multiple layers of security. Xero is a powerful online accounting software solution for small businesses. Run things smoothly, keep tidy online bookkeeping records, the five types of accounts in accounting and make compliance a breeze. Accounting is popularly regarded as “the language of business” because it doesn’t just help you keep track of your money, but also helps you make informed decisions about your business.

Extensive data storage within accounting software increases your company’s efficiency, allowing quick access to details like payment history. Accounting software, including cloud-based programs, is changing the way businesses complete accounting tasks. In some cases, small business owners may be able to do their own accounting, especially with the use of software. At the same time, accountants are increasingly expected to be proficient in using software to support small businesses with their accounting and financial needs. If you are a small business, chances are you don’t actually need to hire an accountant.

Organizing and maintaining an accurate record of all transactions will become harder and harder once you start scaling. Then you have to compile all of that data into something more useful that can actually help your business make strategic decisions. When running a small business, you’ll likely find yourself dealing with a ton of day-to-day administrative tasks like accounting.

The best accounting software received top marks when evaluated across 10 categories and more than 30 subcategories. You can use Brightbook’s free accounting software to send quotes to clients, convert them to invoices, bill for time, add discounts or taxes and accept payments through PayPal. There’s also a mobile app that lets you send invoices through iMessage or add widgets to your iPhone’s home screen so that you can easily access overdue invoices. Xero’s online accounting software is designed to make life easier for small businesses – anywhere, any time.