While QuickBooks Online is very popular among business owners, some have problems with the system. Problems stem from the complexity of making simple fixes, debit: definition and relationship to credit such as miscategorizations or duplicate entries. Support is limited, so users are left reading help articles rather than getting a live person to help.

QuickBooks Plus vs QuickBooks Advanced

A Live Bookkeeper cannot begin cleaning up your past books until they receive the required supporting documentation, which your bookkeeper will request from you after your first meeting. Once your bookkeeper receives all the necessary documentation, they’ll typically complete your cleanup within 30 days. In some cases, your cleanup may take longer depending on timeliness of documentation and the complexity of your books. For those who are operating smaller outfits (even as small as a single person, namely yourself), Wave is an excellent choice. It’s free to use as an accounting solution and can enable freelancers, self-employed professionals and similar businesses to accept payments digitally.

Fit Small Business Case Study

Unfortunately, you can’t do both; electing for the trial will result in paying full price at the end of the 30-day period, or you can skip the free trial and pay 50% off for the first three months. While they both also feature mileage tracking and expense tracking, that’s about all the similarities they share. One of the biggest issues you’ll find with QuickBooks is poor customer support. There are also a few kinks in https://www.accountingcoaching.online/normal-balance-of-accounts-3/ how the software is organized, and the software can be a little expensive, especially if you upgrade to the Advanced plan for more features and users. However, the sheer number of features and strong accounting still make QuickBooks Online a good option for small businesses. QuickBooks Online offers a 30-day free trial of three of its plans, a test drive account of QuickBooks Plus, and a demo of its Advanced plan.

What do accountants think of QuickBooks Online?

With Essentials, you can track your unpaid bills easily and pay them directly within QuickBooks. You just need to select the bills you want to pay from the Pay Bills window, place a checkmark next to the bills, and then select Save or Save and Print. The QuickBooks Online comparison chart below highlights some of the key features of the five versions.

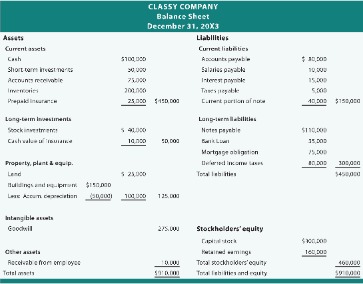

QuickBooks Online dominates the market for small business accounting software due to its extensive features and flexibility in meeting the needs of nearly any small business. It can track inventory costs, generate invoices, track unpaid bills, and calculate P&L separated by many factors, including user-defined classes and locations. All plans include basic features, such as income and expense tracking, invoicing, bank feeds, and reporting. However, the higher plans offer advanced features, as summarized in the QuickBooks Online pricing and feature comparison table below. Moving up to the Essentials Plan, you’ll pay $30 per month for the first three months, then $60 per month.

- You can use it to track income and expenses, pay bills, invoice customers, and run reports like cash flow statements.

- In addition to QuickBooks Online, Intuit offers a desktop product called QuickBooks Desktop, which is locally installed rather than cloud-based.

- If you operate in multiple international locations QuickBooks allows you to accept payment in local currencies.

- Small business owners that previously used spreadsheets save an average of 25 hours per month on manual entry with QuickBooks3.

- QuickBooks Self-Employed is suitable for freelancers and independent contractors who want to be able to track all their business expenses (such as rent or marketing) in one place.

Account Information

When you are free of financial worries, you can focus on driving business growth and revenue. As a business owner, you know how important it is to manage a regular positive cash flow. QuickBooks Payments makes it easier for you to accept online payments when you send invoices from within the app. With QuickBooks, it is very simple to track time as well as billable expenses incurred by employees or subcontractors.

Most importantly, Plus will separate the cost of your ending inventory from COGS using first-in, first-out (FIFO). You’ll need to make this tedious calculation in a spreadsheet if you choose a lower-tier plan. If you choose to cancel your QuickBooks https://www.quickbooks-payroll.org/ Online subscription, you will still have access to your QuickBooks Money account and data. QuickBooks Online can be accessed anywhere you have an internet connection, and because it’s web-based, you can work with your accountant in real time.

You can even photograph and save receipts with the QuickBooks Online mobile app. Once you have a handle on day-to-day use of the QuickBooks Online accounting software, try adding a few more tips and tricks to help you get the most out of the experience. QuickBooks Online stands as the best accounting software that our researchers have tested, due to a great feature catalog, reporting tools, a top-quality support team, and a customizable interface. Tax season arrives for everyone, and your business should be prepared ahead of time. Find out which tax deadlines are relevant, depending on the federal, state, and local regulations that may apply to your operation. If you’re using QuickBooks Payroll, it has the tax reporting functionality needed to walk you through this process, although you’ll still need your federal and state ID numbers.

Get a feel for what QuickBooks can do and try out top features using our sample company.

Plus, with access for up to 40 users, Enterprise can scale with your business as it grows. QuickBooks Desktop Premier Plus and Enterprise plans have industry-specific reports for manufacturing and wholesale, retail, nonprofit, general contractor and professional service businesses, too. For example, nonprofits can use the desktop products to run donor contribution summary reports while manufacturing, wholesale and retail businesses have the ability to forecast product sales. Contractors and professional service businesses can use the software to compare revenue by city, customer and job type. QuickBooks Online offers a large selection of reports, but they aren’t industry-specific. With four plans, robust features and a user-friendly interface, QuickBooks Online is the ideal choice for most small businesses.

Zoho Books is the accounting and finance portion of the platform, and it’s no slouch, even when compared to something like QuickBooks. Excel is a spreadsheet program that you can use for multiple functions like creating databases, project management and, yes, accounting. However, creating a solid accounting database in Excel requires a thorough knowledge of how to set up spreadsheets and all the formulas that may entail. QuickBooks allows you to keep track of financial functions like income and expenses, employee expenses and inventory in real time and fulfill tax obligations hassle-free.

Automatically sort transactions from connected accounts into tax categories for easy organization. Automatically sort business expenses into the right tax categories to keep more of what you earn at tax time. Monitor product levels, cost of goods, and receive notifications when inventory is low so you never run out. Use class tracking to sort transactions and categorize income and expenses. Custom user roles and permissions let your clients manage access to sensitive information and delegate work to specific employees.

Once the data is finalized in Excel, you can easily post it back to QuickBooks Online Advanced. Batch expensing allows you to record and categorize multiple expenses at once instead of entering them individually. This is especially useful if you have many expenses to record, such as business travel expenses, office supplies, and equipment purchases. You can upload expense receipts in bulk, categorize them according to the appropriate expense account, and then submit them for approval.

Intuit reports that 94% of accounting professionals feel QuickBooks Online saves them time and thus saves their clients money. Tracking inventory as you sell them, entering the details in the right expense account and calculating taxable income at the end of the financial year can be very cumbersome manually. Both QuickBooks Online and QuickBooks Self-Employed are great software, whether you need them for real estate accounting or nonprofit accounting. Still, there is other software out there that can perform just as well—and in many cases, at a lower cost.